Configure a tax strategy for your marketplace

As a Marketplace Manager, you will need to set up tax settings for your marketplace depending on your business model, the regions you operate in, and the types of products your marketplace sells. This help topic explains the different tax strategies available in an AppDirect marketplace, their key features, and the situations where each strategy works best.

❗ Important The information on this page is for guidance only. The choice of which tax strategy to apply rests entirely with your company or marketplace operator.

Overview of Tax Strategies

A tax strategy defines how taxes are calculated for all transactions in your marketplace. Here are the available tax strategies in marketplaces and a short overview on when to use them.

| Tax Strategy | Recommended Use Case | Recommended Region | Additional Information |

|---|---|---|---|

| No Tax (None) | Off-platform billing: invoices are generated externally, and that system adds taxes. Minimal tax environments: taxes are small and handled manually. Non-taxable customers: marketplaces serving nonprofits or institutions exempt from tax. | N/A | Can also be used in sandbox marketplaces for testing. |

| Global Flat | Use when you have to configure one tax rate for all marketplace transactions, regardless of region Best for regions with simple VAT-like systems | Europe and LATAM | |

| Multi-Flat | Use when you have to configure a flat tax rate per country. Ideal for marketplaces selling in multiple regions within a single currency (EU) | Europe and LATAM | Also use for edge cases or custom needs |

| AvaTax | Integrates with Avalara’s third-party tax engine for precise calculations Ideal for US and Canada marketplaces where taxation for digital and physical goods depend on ZIP codes and product rules. | United States and Canada | |

| Canadian Flat | Provides per-province configuration in Canada Supported taxes: GST, PST, HST Flexibility: resellers can specify whether they are registered for tax or not | Canada only | Can be configured per product type |

To configure one of the above tax strategies for your marketplace,

-

Go to Marketplace > Settings > BILLING SETTINGS | Tax Settings.

-

Click Edit in the Marketplace Tax Strategy section.

-

In the Tax Strategy field, select the tax calculation method for your marketplace. The options in the UI change based on your selection.

-

Avalara - create a new Avalara tax account or link an existing one. Once your account is configured, Avalara automatically calculates taxes for purchases based on the location and applicable tax rules. For more information on how to configure your Avalara tax account, refer to Configure Avalara tax settings.

-

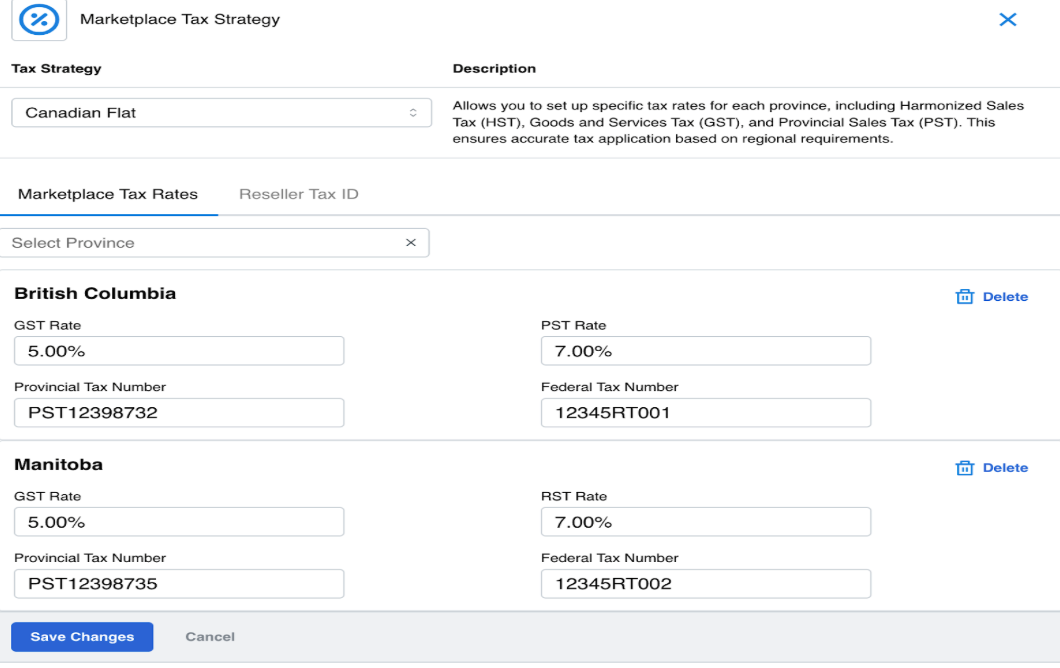

Canadian Flat - select a province and specify tax rates, including Harmonized Sales Tax (HST), Goods and Services Tax (GST), and Provincial Sales Tax (PST).

-

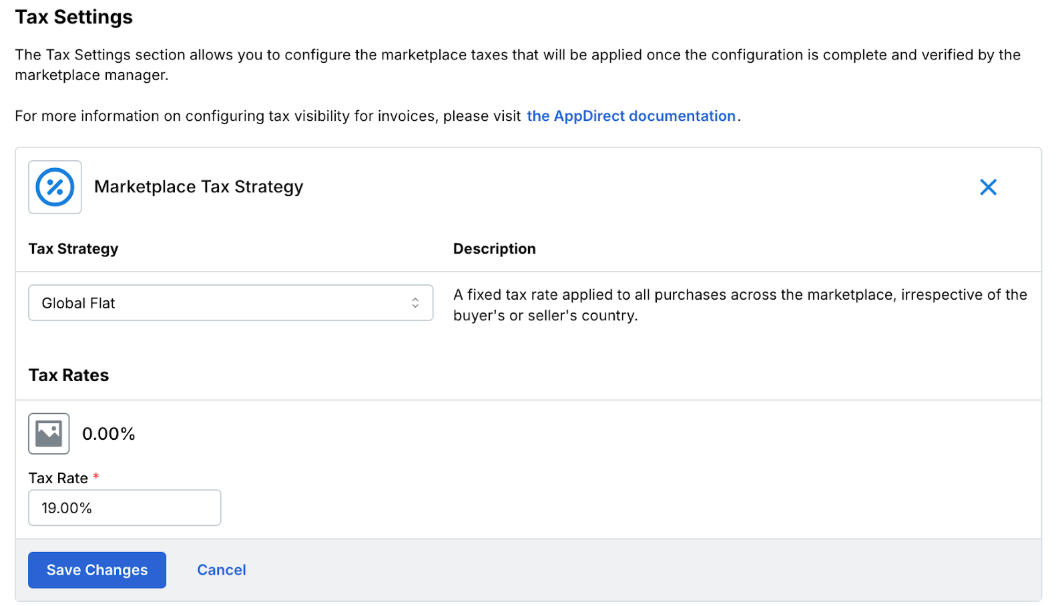

Global Flat - enter a tax rate that is used for all marketplace transactions. Click Save Changes, then confirm the tax strategy.

-

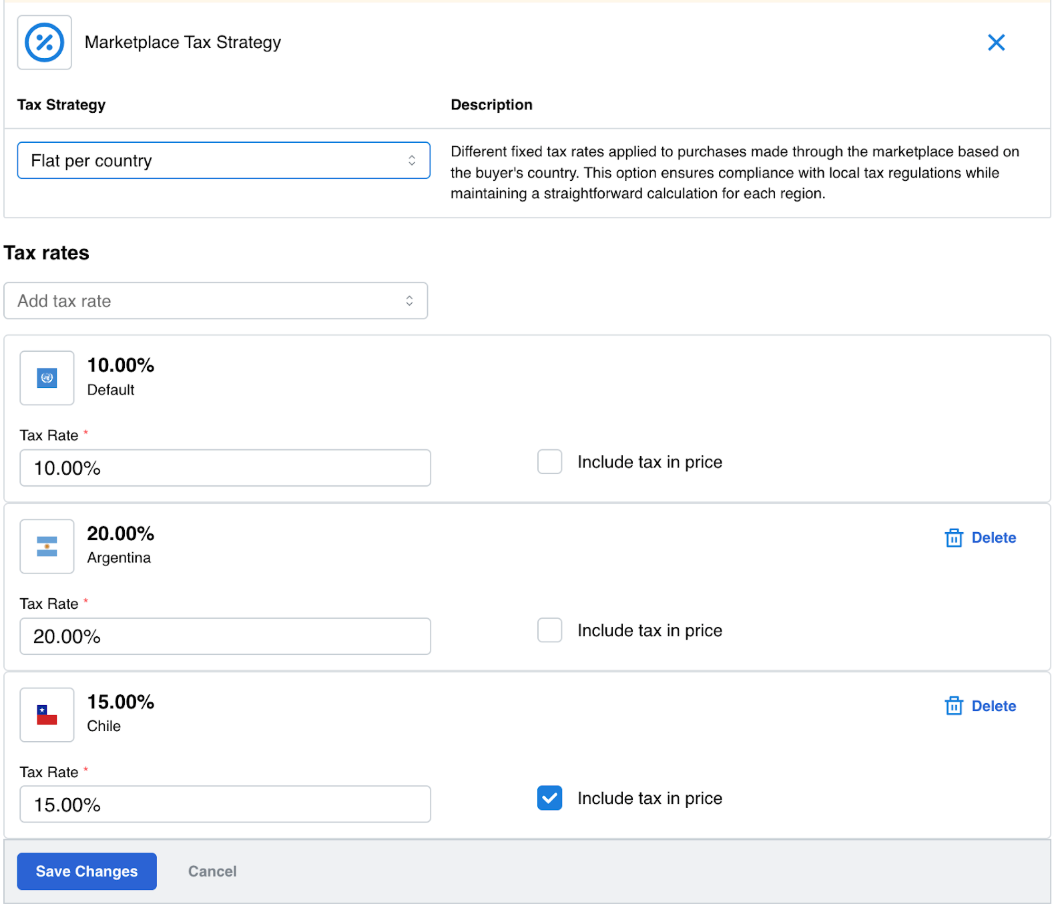

Flat per country - select a country/region and specify its tax rate. You can configure taxes for different countries/regions. Products are taxed based on the country in the billing address of the buyer.

-

None - select this option if you don’t want to apply taxes for purchases or other transactions made in your marketplace.

-

-

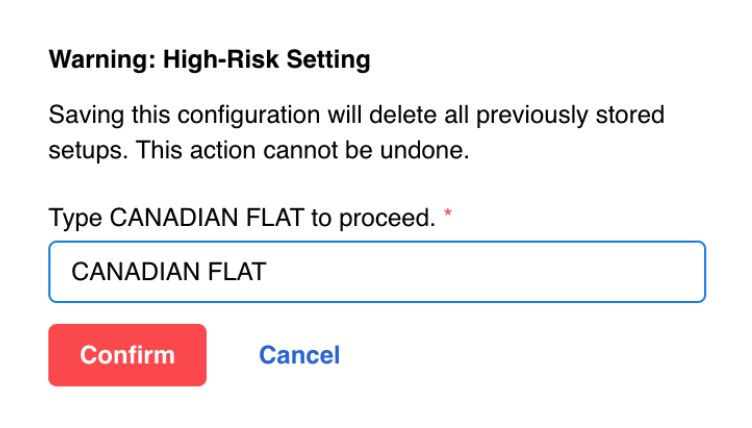

Click Save Changes. Every time you select a tax configuration in marketplace settings, you must confirm the change after saving. The previous configuration is removed and cannot be restored.

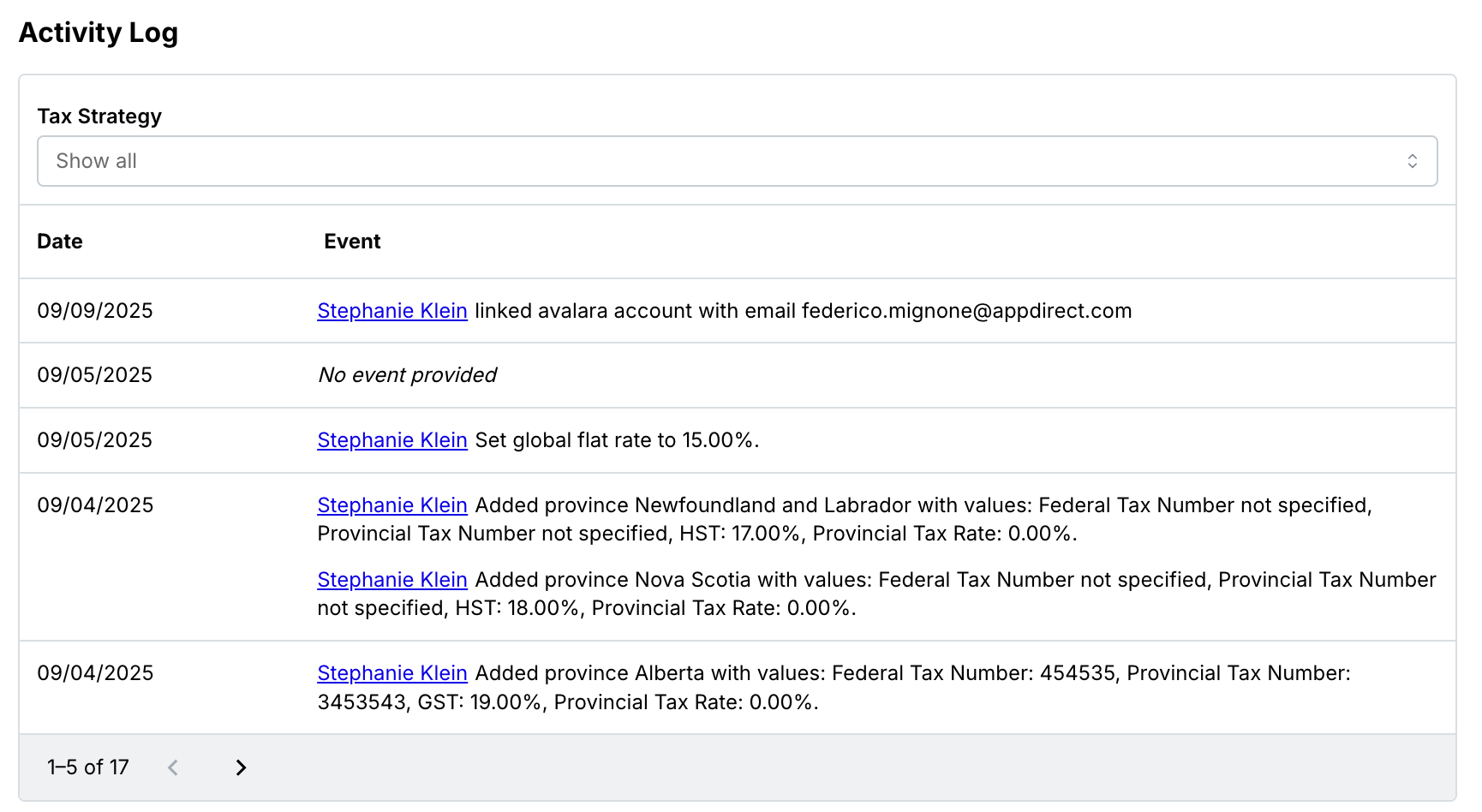

Activity Log

All changes to tax strategy settings are recorded in the Activity Log. You can also filter log entries by a specific tax strategy.

Was this page helpful?

Tell us more…

Help us improve our content. Responses are anonymous.

Thanks

We appreciate your feedback!