View payments and refunds

The Payments table displays a summary of all payments and refunds, and includes details about each one. Click any row in the table to display additional details about the payment or refund.

To view payments and refunds

- Go to Manage > Account > Billing > Manage Bills | Payments. The Payments table appears.

- (Optional) Search for any text contained within the payment data (for example, a product name, edition description, discount description, or customer name), or filter the payment rows by clicking Show Filters. The following filters are available:

- Payment method (for example, Paypal, credit card)

- Type (payments, refunds)

- Payment result (successful, failed, pending for ACH payments only before the financial institution confirms that they are successful or failed, gateway not available, off-platform)

- Created between dates

As you select filters, the table content automatically updates.

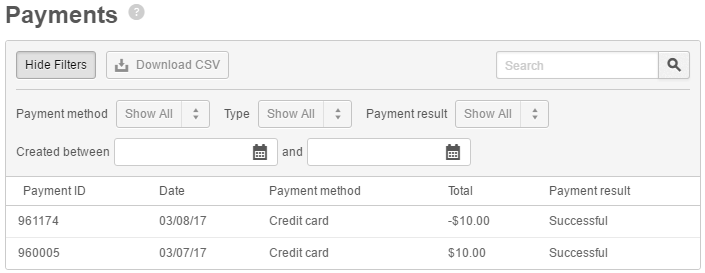

The following image is an example of the payments table, with the search and filters fields. It contains a refund (refunds have a negative value in the Total column), and a payment.

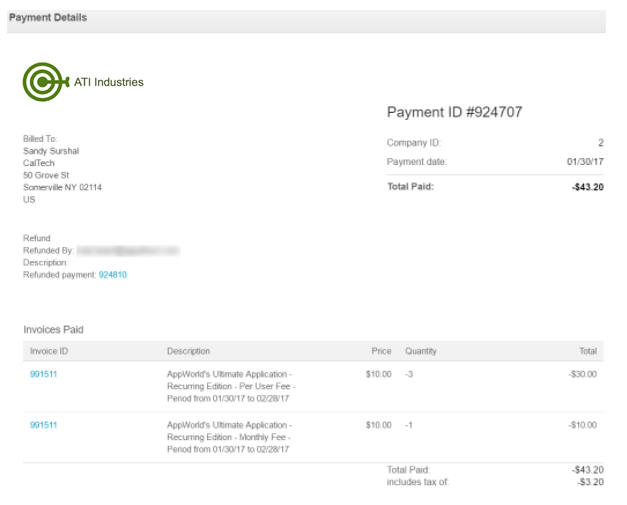

- Click a payment (or refund) row. The Payment Details popup appears. The following image shows a refund payment example. Descriptions of each invoice element follow the image.

Note the following payment details in the image:- Billed to—Purchaser’s contact information.

- Refund—Notation marking this as a refund.

- Refunded by—User ID of the person who processed the refund.

- Description—Reserved space for free text to describe the refund.

- Refunded payment—System-generated ID (#924810, in this example) assigned to the payment that was refunded by this transaction.

- Payment ID—System-generated ID (#924707, in this example) assigned to this payment or refund.

- Payment date—Date the automatic payment was processed or date the user entered for the off-platform payment.

- Total paid—Amount of this payment. For refunds, the total amount paid is negative.

- Invoices paid table—Bottom of the payment popup lists the invoices paid with this payment:

- Invoice ID—ID of the invoice paid (or, if negative, refunded) with this payment.

- Description—Product and edition purchased (for which the refund is issued).

- Price—Price of the product without tax.

- Quantity—Quantity purchased or refunded. (For refunds, this could be less than the quantity purchased as partial refunds can be processed.)

- Total—The price multiplied by quantity.

- Includes tax of—In this example, of the $43.20 credit processed (expressed as -$43.20 on the invoice), $3.20 (-$3.20) was tax.

Was this page helpful?

Tell us more…

Help us improve our content. Responses are anonymous.

Thanks

We appreciate your feedback!